Spring 2021 McGriff Market Update: Construction

The construction market continues to tighten across multiple lines of coverage, resulting in rate increases and more restricted policy terms. These increases and terms have created the first hard market in the past 20 years, causing many contractors to scramble to maintain some level of consistency in risk management costs.

Summary Forecast for 2021

With the changing market conditions, contractors have to approach their renewals with care. Here is a summary of key considerations:

- Since auto liability losses are increasing regardless of the type of power unit, underwriters are more concerned about fleet count and location, rather than composition.

- While it’s true that excess capacity is technically available, deployment is drastically reduced for any single insured.

- International capacity (London and Bermuda) have some new players, but capacity is still about half of what it was last year.

- Wildfire exposures are even more challenging, regardless of exposure to the 14 western states. Contractors with true wildfire exposure will pay 30% rate online.

- More attention is on captives or alternate markets than in previous years.

- Cyber liability rates are on the rise, and capacity is tightening in the wake of several high-profile loss events.

- Professional CPL remains competitive, yet terms are tightening for design/build exposures and those contractors purchasing faulty workmanship coverage.

General Liability

The construction underwriting community continues to respond to poor underwriting results for General Liability. Pressure from senior management to improve combined ratio performance, along with higher rates from reinsurance partners, has led to renewal increases. We’re seeing a more disciplined approach to new business growth and existing account renewals. Renewals are quite challenged in certain sectors of construction, including street and road contractors, companies with New York labor law and wildfire exposures, and residential contractors.

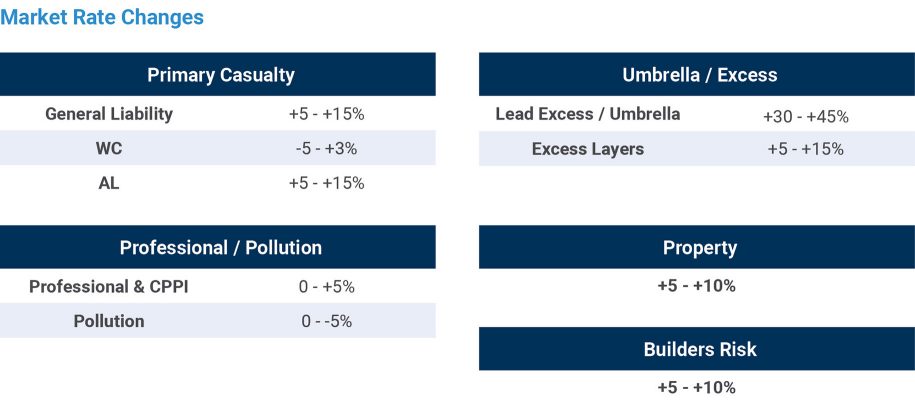

Price increases for General Liability are expected to be in the 5%–15% range, heavily dependent on loss performance. Contractors in the street and road sector should expect increases in the upper range of that forecast due to an escalating loss experience tied to work zone accidents.

Automobile Liability

For primary casualty, Automobile Liability continues to be a major challenge for the underwriting community. We’re continuing to see a negative trend in the frequency and severity of automobile losses due to jumbo jury awards, distracted driving, increased auto use, more litigation, and fewer pre-trial settlements, among other factors. Our forecast for automobile liability increase are +5% to +15% for 2021. This is highly influenced by loss performance, fleet composition, number of power units, geography and fleet safety protocols.

Workers’ Compensation

Perhaps the only major casualty line in construction where the news is good for 2021 is Workers’ Compensation. The insurance industry continues to enjoy favorable combined ratios for this line (with a few exceptions in some states), resulting in favorable renewals for contractors. Thanks to a robust employment environment, an increased focus on safety, and better claims management, loss experience in construction has improved, which has led to lower work comp loss rates for most states. Our forecast for Workers’ Compensation is flat to +3% for contractors, while those with large deductibles could see rate decreases in the -3% range. Of course, individual renewal rates will be highly influenced by individual company loss performance.

Umbrella/Excess

The most challenging of all lines of coverage for 2021 renewals is Umbrella/Excess. A downward trend that began with June 1, 2019, renewals has continued in each subsequent quarter throughout 2020 and into 2021. It’s fair to say the market is in a controlled stage of turmoil. Capacity is prevalent, but at a price increase heavily dependent upon the construction industry sector. The underwriting experience continues to be poor for the industry, with pressure to increase rates coming from both internal management and reinsurers. Major underwriters are focused on overall rate performance at the expense of client retention. Some industries, such as street and road, face unique pressures. Contractors with substantial fleets also face unique market issues.

Contractors with high-limit towers will require many additional underwriters to complete their programs. Regarding lead market underwriters, we’ve seen a reduction in lead limits in the past 15 months. Prior to that, several underwriters could support leads of $25 million. Now underwriters in a lead position are reducing limits to $15 million, sometimes as low as $5 million. While it’s still possible to lead with $25 million, many excess underwriters are managing their limits exposures, especially for certain types of contractors, or in jurisdictions with higher construction defect exposures.

Attachment points for excess are also presenting a challenge. While we have generally migrated to a primary GL limit of $2 million to $4 million and an AL of $2 million over the past two to three years, we’re now seeing higher attachment requirements. Contractors with large fleets (more than 250 power units) should anticipate $3 million in primary limits requirements. And larger fleets should expect primary limits of $5 million. Some lead markets are requiring attachment points of $10 million for GL for street and road contractors, something we see as highly problematic.

Our renewals forecast is changing quarterly. We’re currently forecasting renewal rate increases for lead limits at +20%–40%, with excess layers at +5%–10%. This is of course affected by historical primary and excess loss performance.

Builders Risk/Property Insurance

The overall builders risk and property markets are firming in 2021, the result of continued natural catastrophe losses, major fires, explosions, water damage issues and collapses. U.S. markets are stable with firming prices. London, and in particular Lloyd’s, has seen reduced capacity on the builders risk side, with the reduction or exit of certain syndicates. The Wood-Frame Builders Risk market continues to be particularly tough as fewer carriers continue to put out capacity. Depending on size and location, these projects will most likely require quota-share participation paired with stringent project protection required.

Contractors should expect more scrutiny of project locale, with a focus on exposure to natural cat losses (windstorm, named storms and flood). Also, we’re seeing a strong focus from builders risk underwriters on water damage exposures for partially completed projects in addition to construction means and methods. Overall negotiations on terms and conditions are critical to successful placement.

We expect builders risk and general property increases of +5%–10% for 2021. Terms for water damage, project security and civil commotion continue to be problematic.

Professional and Pollution Liability

Another favorable line of coverage for contractors in 2021 is Professional and Pollution Liability. With a favorable overall loss experience and ample support from underwriters, the market is robust. The exception would be for contractors with large design and build projects, where the 2020 loss experience has been poor overall due to significant large losses. As a result, we’re seeing increased rates with additional scrutiny of design/build partners and project parameters for those large projects. For professional and CPPI, we’re forecasting rate increases in the +5% range. For pollution, depending on individual historical loss experience, contractors should anticipate flat to -5% rate renewals.

Surety

The contract surety bond market is experiencing slightly decreased demand and more underwriting scrutiny in 2021. The demand for bonds is being negatively impacted by lower tax revenues to support public projects and delayed project starts due to uncertainty related to the pandemic. Although there has not been a significant uptick in bond losses recently, underwriters are bracing for potential loss increases in 2021. As a result, surety underwriters are placing more emphasis on a contractor’s ability to service debt, access cash, and manage cash burn. Contractors, meanwhile, are challenged with retaining employees while facing uncertainty about what their backlog will look like when project activity resumes in earnest.

Commercial surety results could affect contract surety pricing if losses rise significantly. Since commercial surety markets write a substantial amount of financial guarantee bonds for pandemic-impacted travel, hospitality, retail industries, and the depressed energy sector, rising losses are conceivable for the next 12 months.

We forecast a continued decline in bond demand and stricter bond underwriting for the remainder of 2021 as the effects of the pandemic are more fully realized in the construction industry.

Insurance products and services offered through McGriff Insurance Services, LLC, a subsidiary of Truist Insurance Holdings, LLC, are not a deposit, not FDIC insured, not guaranteed by a bank, not insured by any federal government agency and may go down in value.

McGriff Insurance Services, LLC. CA License #0C64544